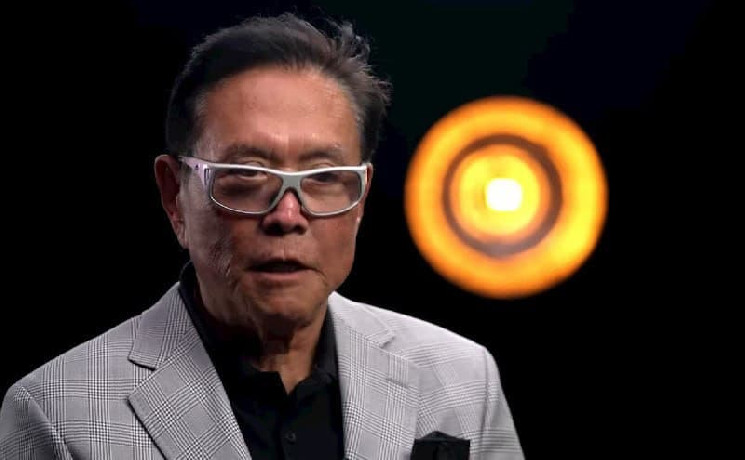

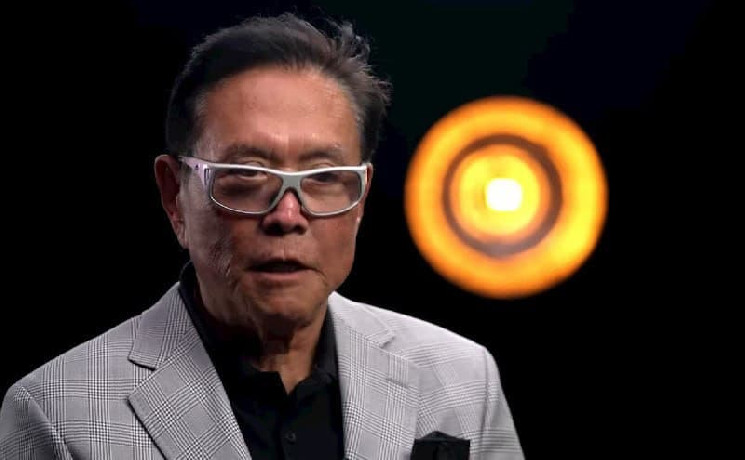

Amid his numerous warnings of a looming economic collapse that could engulf the United States and beyond, popular investor and author of the best-selling personal finance book ‘Rich Dad Poor Dad’ Robert Kiyosaki has recently sounded an alarm on multiple other issues.

Specifically, Kiyosaki has urged his followers to be careful because, in his view, the banking crisis is worsening and the threat of war grows, and the US authorities might use the opportunity to push for a central bank digital currency (CBDC) to spy on their citizens, he said in an X post on February 25.

Please be careful. Banking crisis worsens. Threat of war grows. Cental banks will push for CBDC, Cental Bank Digital Currency, to SPY on us. I am buying more Bitcoin and silver coins. Silver biggest bargain. I will use silver as money not US fake dollars

— Robert Kiyosaki (@theRealKiyosaki) February 25, 2024

Buying more Bitcoin and silver

At the same time, the renowned finance educator shared his strategy for circumventing the above dangers, which involves stocking up on more Bitcoin (BTC) and silver coins, particularly the latter, which he described as the “biggest bargain,” vowing to use it as money instead of the “US fake dollars.”

As a reminder, Kiyosaki has long expressed his support of the flagship decentralized finance (DeFi) flagship, as well as the precious metals silver and gold, although he has apparently somewhat moved away from gold in his rhetoric, arguing it could crash “possibly below $1,200.”

On the other hand, unlike gold, he believes that Bitcoin and silver “will take off,” earlier in particular voicing his expectations of even stronger gains for the former than what it has recently experienced, arguing it might hit the price of $100,000 by June 2024, as Finbold reported on February 19.

Meanwhile, the maiden cryptocurrency was at press time changing hands at the price of $51,318, recording a slight pullback of 0.72% in the last 24 hours and declining 2.09% across the previous seven days but still holding onto the 23.14% gain on its monthly chart, as per data on February 26.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.