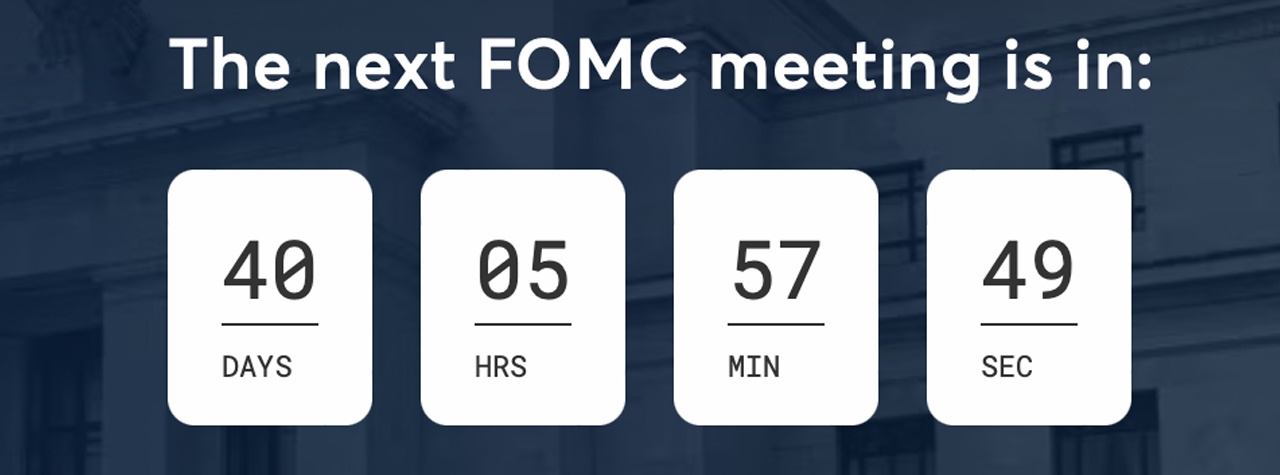

In just 40 days, the U.S. Federal Open Market Committee (FOMC) will gather to decide whether the central bank will lower the benchmark interest rate. This pivotal moment occurs two days after the 2024 U.S. Election Day. As it stands, CME futures data suggests that a half-point reduction is currently viewed as more probable than a quarter-point adjustment.

Prediction Markets and Fedwatch Tool Split on Rate Cut Forecasts

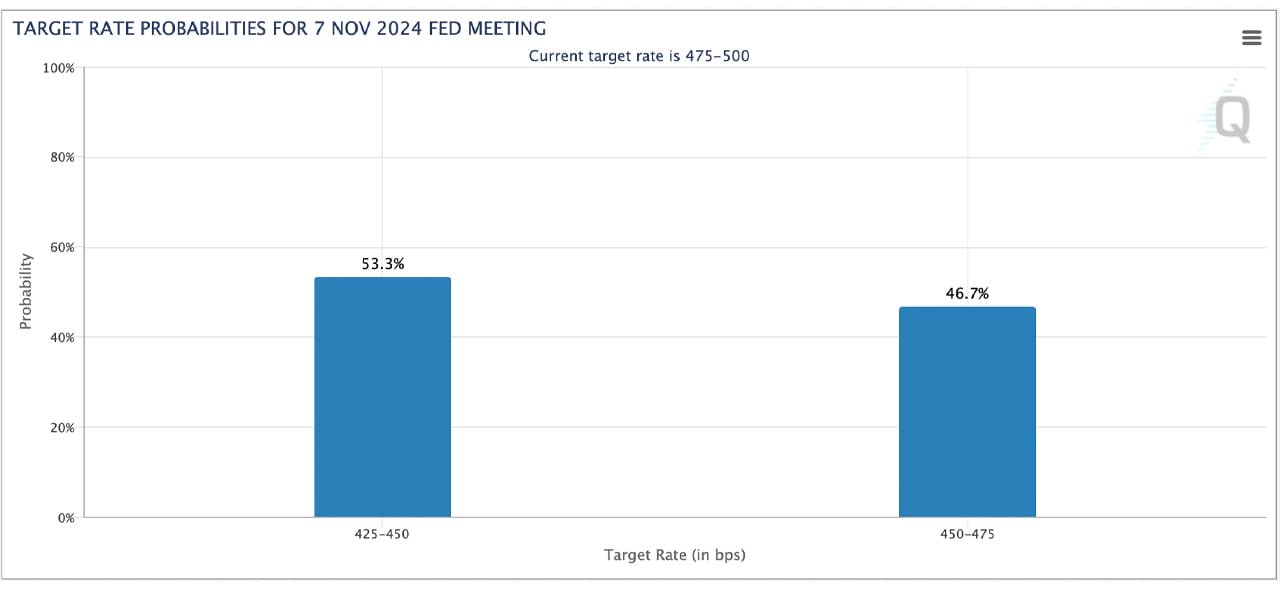

As of Sept. 28, 2024, the CME Fedwatch tool reveals that the likelihood of a 50 basis point cut outweighs the odds of a 25 basis point reduction. The half-point trim currently stands at 53.3%, edging out the 46.7% chance for a quarter-point drop.

The FOMC meeting will occur two days after the 2024 U.S. election.

While CME’s data is usually quite reliable, the race between the two options is tight, and the numbers could very well shift in the next 40 days. The odds for a half-point reduction climbed after the U.S. ‘Core’ Personal Consumption Expenditures (PCE) Price Index report was released on Friday.

CME Fedwatch tool odds on Sept. 28, 2024.

The report noted a 0.1% increase in August, bringing the year-over-year inflation rate to 2.2%. The PCE index is often considered one of the Federal Reserve‘s preferred inflation measures.

Meanwhile, CME’s Fedwatch tool doesn’t even have a three-quarter point reduction in the cards for the upcoming November FOMC meeting. Over on Polymarket, though, a bet with $6.54 million in volume does factor in a potential three-quarter point cut—though the odds of it happening sit at a slim 2%, according to market bettors.

Polymarket’s odds on Sept. 28, 2024.

Polymarket gives the quarter-point reduction a 50% chance, while a half-point cut comes in close with 46%. The odds of no rate change stand at 3%, while a quarter-point interest rate hike holds a curious negative 1% probability at the moment.

As the FOMC meeting draws near, changing odds highlight the uncertainty surrounding the Federal Reserve’s upcoming decision. Though futures and prediction markets are leaning toward a half-point and quarter cut, upcoming economic data could easily shift the outlook.

With 40 days remaining, market watchers are closely monitoring inflation reports and election results, as these factors will play a crucial role in the Fed’s next decision.

What do you think the Fed will do during the next FOMC meeting? Share your thoughts and opinions about this subject in the comments section below.