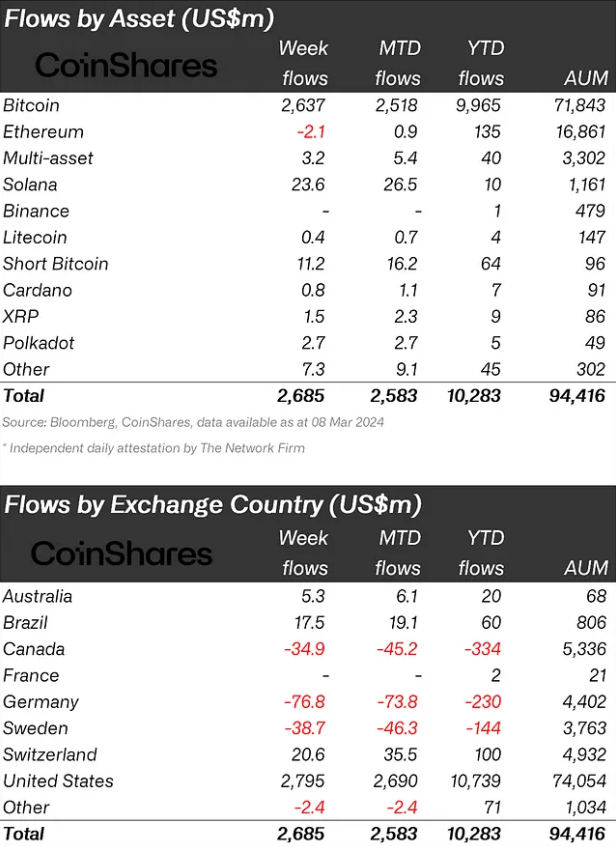

Crypto investment products registered $2.7 billion in inflows over the last week, a new weekly record, according to a report from asset management firm CoinShares. This capital injection has propelled the year-to-date total flow to $10.3 billion, nearing the all-time high of $10.6 billion recorded for the entirety of 2021. Bitcoin has been the primary beneficiary, attracting $2.6 billion and accounting for 14% of the total Assets under Management (AUM).

The trading turnover for digital assets has also seen a substantial increase, reaching a new high of $43 billion this week, a considerable jump from the previous record of $30 billion. This uptick in trading activity coincides with a 14% increase in AUM over the last week, pushing the total to over $94 billion, marking an 88% rise since the beginning of the year.

Image: CoinShares

Despite a recent uptick in short positions, Bitcoin continues to attract investment, with an additional $11 million flowing into short Bitcoin products last week. On the other hand, Solana has rebounded from negative market sentiment, securing $24 million in inflows. Ethereum, despite a strong performance year-to-date, faced minor outflows of $2.1 million. Other altcoins such as Polkadot, Fantom, Chainlink, and Uniswap also saw inflows, with amounts ranging from $1.6 million to $2.7 million.

In terms of regional distribution, the US led the inflow with $2.8 billion, followed by Switzerland and Brazil with $21 million and $18 million, respectively. However, some countries like Canada, Germany, and Switzerland have realized profits, resulting in outflows of $35 million, $77 million, and $39 million, respectively.

Blockchain equities did not share the same bullish sentiment, experiencing minor outflows totaling $2.5 million.