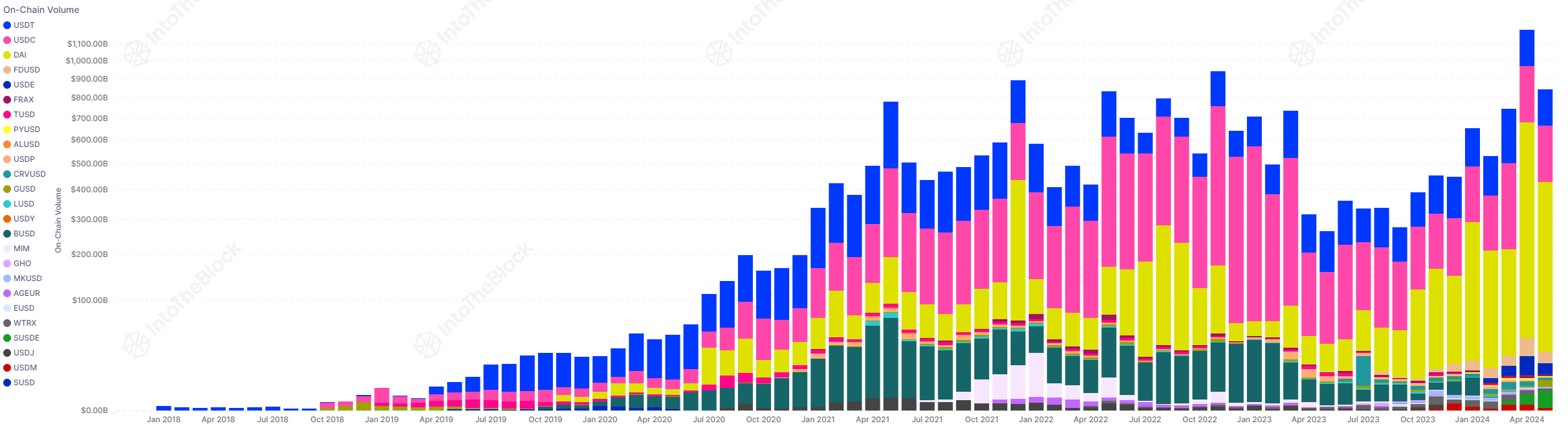

Stablecoins surpassed $846 billion in on-chain trading volume, according to on-chain data platform IntoTheBlock. Despite a 30% drop in monthly trading volume and the total stablecoin supply remaining $20 billion below its peak, the market demonstrates robust activity.

Additionally, IntoTheBlock’s “On-chain Insights” newsletter highlights that stablecoins are increasingly recognized for their potential to cut the hefty fees of international remittance, mentioning a Coinbase study that underscored how Americans pay nearly $12 billion annually to send money abroad.

Stablecoins on-chain monthly trading volume. Image: IntoTheBlock

The newsletter also pointed out PayPal’s PyUSD emerging as a key player, with a market cap nearing $400 million. PyUSD is now the tenth largest and one of the fastest-growing stablecoins, with a 21% raise in April.

Notably, PayPal announced the addition of its stablecoin on the Solana blockchain on May 29th, which was previously limited to Ethereum. Solana ecosystem shows over $3 billion in stablecoin market cap, with the USD Coin (USDC) currently dominating over 72% of the market share.

This move followed an April announcement that Xoom, PayPal’s money transfer service, would allow US customers to send stablecoins to about 160 countries fee-free.

Stablecoin rise in usage

As reported by Crypto Briefing, the on-chain trading volume of stablecoins surpassed $1.3 trillion in April, which was more than the average monthly volume processed by Visa last year.

Tether USD (USDT), the largest stablecoin by market cap, processed $654 billion in transactions in the last 30 days, while over $394 billion was transacted using MakerDAO’s DAI. USD Coin (USDC) got third place, reporting $321 billion in trading volume during the same period.