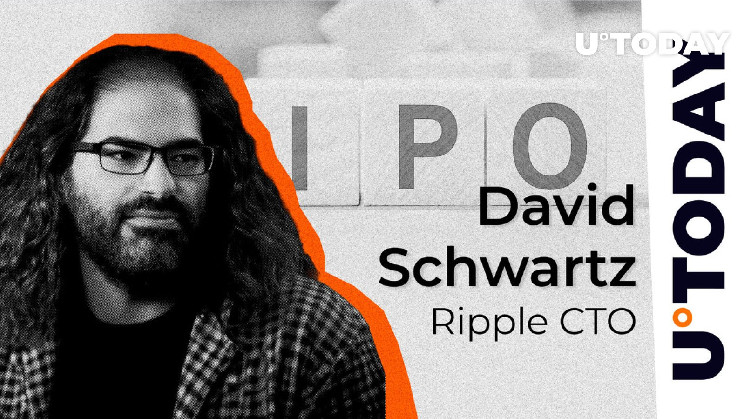

There was an interesting discussion involving Ripple CTO David Schwartz in the crypto space on the topic of companies going public. Initially, the view was expressed that all tech companies that have gone public in recent years have performed dismally in their IPO offerings.

The same view was echoed by another debater, who stated that in the startup world, such decisions are seen as a cash exit for its participants. In particular, an example is given when a developer joins a project for a low salary, but on the condition of a share in a future company, which acquires value just by going public.

Schwartz, who is no stranger to getting involved in all sorts of startups and nascent initiatives, as he is one of the original architects of XRP Ledger, also decided to join the discussion.

His words are particularly interesting in the context of Ripple preparing for its own IPO. After the court disagreements with the SEC were settled, at least until the appeal was filed, it seems that the road to going public for the crypto company has opened. Even figures around $30 billion were mentioned, which incidentally corresponds to the current capitalization of XRP — a cryptocurrency actively used by Ripple in its operations.

Playbook

Schwartz stated that getting into the money through an IPO for the developers matters, unless they can sell their shares on the secondary market, participate in buybacks or tender offers, and receive dividends. If the company is doing well enough and management allows it, there are plenty of other ways to turn your shares into dollars, Schwartz states.

An IPO is a good way out if the company cannot do any of those things, or not enough of them. On the other side, however, notes the Ripple CTO, early investors get especially nervous when they get too far away from their desired liquidity dates.