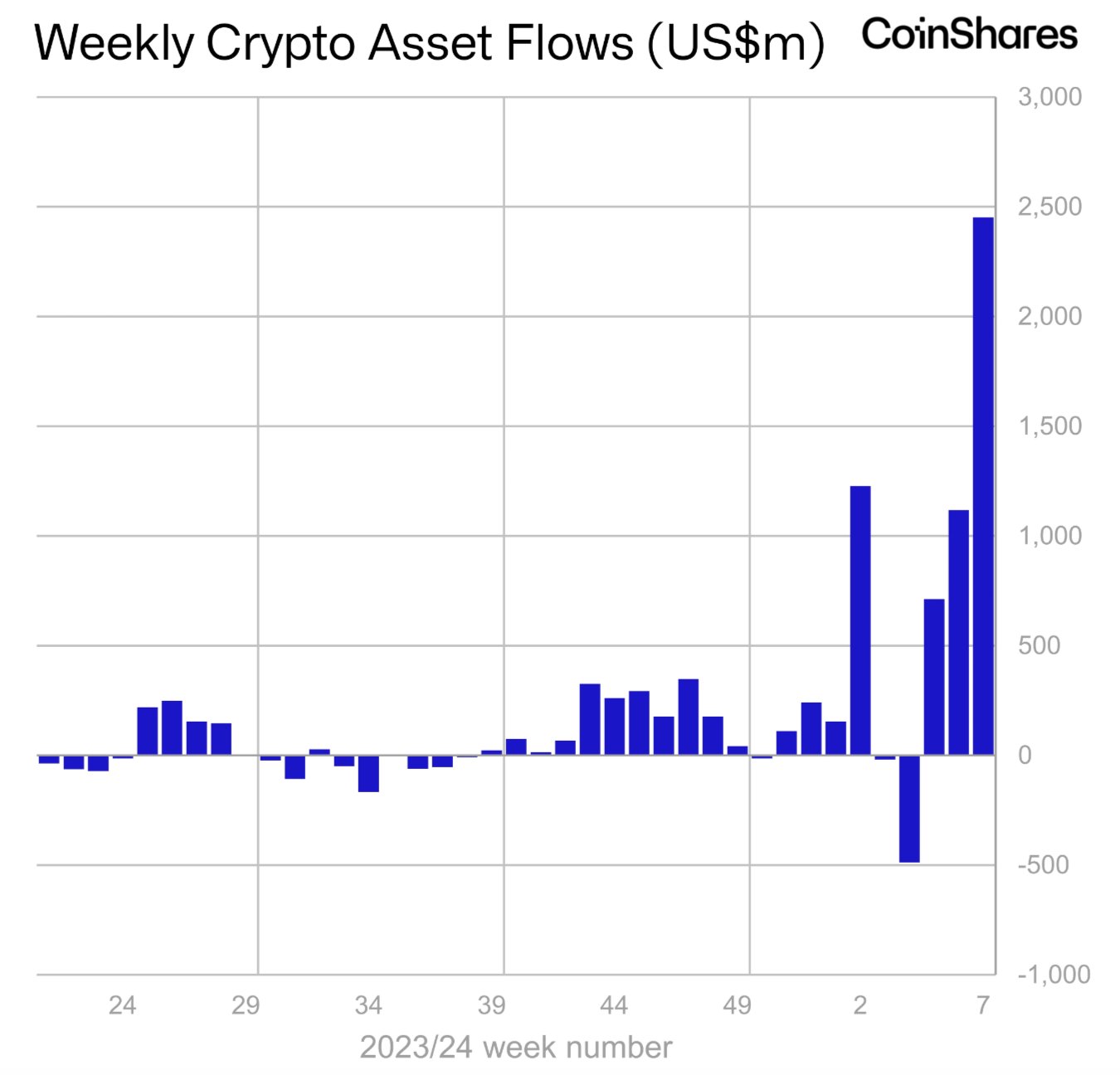

The cryptocurrency market witnessed an unprecedented influx of $2.45 billion in digital asset investment products last week, setting a new milestone, as revealed by the latest report from CoinShares.

This staggering figure brings the year-to-date inflows to an astounding $5.2 billion, with the week ending on February 16 acting as a major catalyst.

The United States played a pivotal role, contributing $2.4 billion, accounting for a staggering 99% of the total inflows.

Source: CoinShares Report

Bitcoin Leads the Charge

Bitcoin emerged as the frontrunner, spearheading the surge by capturing nearly all the product inflows. Notably, a mere $5.8 million flowed into short-Bitcoin products, highlighting the bullish sentiment surrounding the flagship cryptocurrency.

Ethereum, the second-largest cryptocurrency by market capitalization, saw substantial inflows totaling $21 million.

While alternative cryptocurrencies such as AVAX, LINK, and MATIC witnessed minor inflows, the standout performer was Solana (SOL), which experienced outflows amounting to $1.6 million.

Global Bitcoin ETF Flows Surge

Data from ETC Group revealed a significant uptick in year-to-date net flows into global Bitcoin exchange-traded funds (ETFs) and products, with a notable increase since the beginning of February. This surge is partly attributed to a slowdown in outflows from Grayscale’s converted GBTC fund, as indicated by data from The Block.

Last Thursday marked a pivotal day for ETF inflows, totaling $389.55 million against an outflow of $168 million. BlackRock’s iShares Bitcoin ETF (IBIT) secured the lion’s share of inflows, receiving a substantial $224.3 million on that day alone.